Fixing Electronic Matching Service – "Fix deals"

Launched: 4th of September 2017 (Phase 1 with T+0 trading)

Summary: Fixing electronic Matching service "Fix deals"

General information:

- On-exchange service with new fixing tool instruments and subsequent clearing/ settlements via MOEX group central counterparty (NCC bank)

- New instruments: USDRUB_FIX0 and EURRUB_FIX0

- Trade date: Т+0 (same day of MOEX FX Fixings calculation date)

- Trade time: 10:00 – 12:15 MSK

- MOEX FX Fixing calculation time: 12:30 MSK (T+0)

- Settlements: Т+1

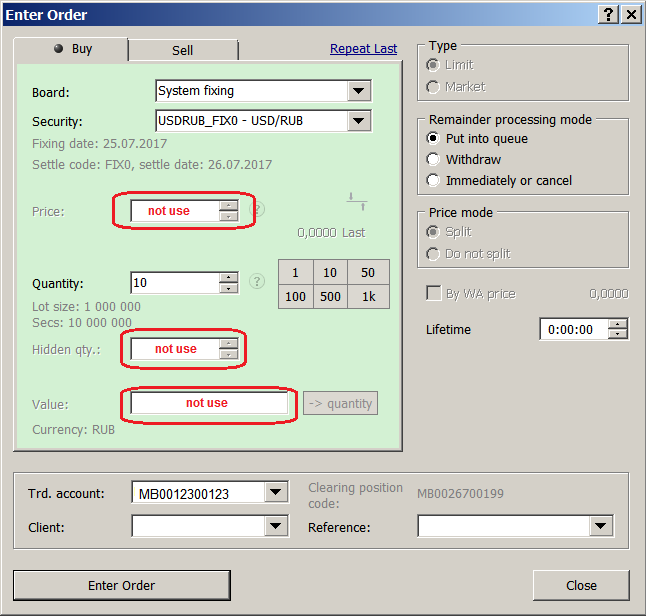

Submission of fix orders

- Orders for fix instruments are submitted during trade time (10:00 – 12:15 MSK)

- 2 trade modes: System board deal mode (FIXS) and Negotiated deal mode (FIXN);

- Fix order types are available:

- good till cancel (put into queue)

- immediate or cancel (withdraw remainder)

- fill or kill

- In fix order entry window a participant can see Fixing calculation date (T+0), Settlement date (T+1) and enter order volume (in quantity of min. lots)

- No FX price is indicated

Fix deal execution

- Fix deals are considered legally concluded (binding) at moment of a matching with opposite fix orders (continuous matching, first in first served)

- Fix deal concluded means that participant buys or sells USD or EUR against Rubles at MOEX FX Fixing rate of same day T+0) according to MOEX Trading Rules

- one lot = 1 000 000 USD, or EUR

- Price of Fix deal = MOEX FX Fixing rate at 12:30 with tick size 0,0001 RUB per 1 USD

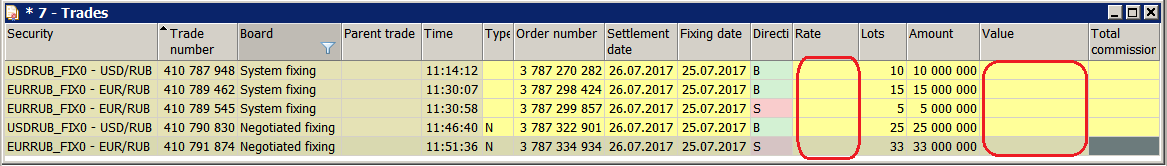

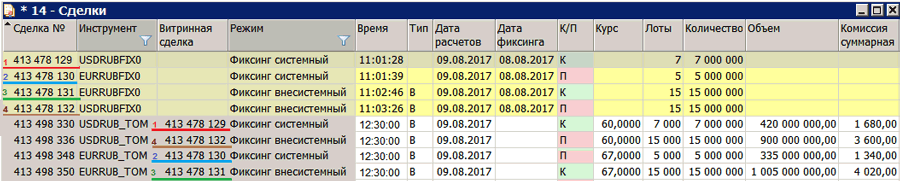

When opposite orders are matched and become fix deal/trade it appears in "Trades" blotter.

- After 12:30 new calculated MOEX FX Fixing rate is applied to fix deals which are treated as deals with value date T+1 (also included into overall netting of all other deals concluded with T+1 value date). Equal proxy USDRUB_TOM deal with same parameters are generated in the system for the purposes of fee calculation and Ruble amount (value) of fix deal at the Fixing rate.

Information disclosure

Information disclosure

During trade time (10:00-12:15 MSK)

- Participant orders (side "buy" or "sell", size of orders) are not displayed (not visible to other participants) in fix order book;

- Overall volume of already matched fix deals and the number of Fix deals are disclosed in trading terminal MICEX Trade Currency and in information terminal MOEX Trade Info

Risk management / Clearing

- Fix orders are checked against available collateral posted at NCC (according to NCC Clearing Rules); collateral in amount of 10% (subject of NCC decision, could be changed) of fix deal size is blocked:

- Ruble equivalent of the collateral is calculated at the Central rate (with 6% haircut for USD and EUR, haircut could be change due to NCC decision)

- Central rate = weighted average FX rate from 6.30 p.m. till 7 p.m. MSK of trading date T-1 daily calculated by NCC Bank (see http://www.nkcbank.com/centralRates.do)

- Opposite fix deal leads to collateral unblocking

- From 10:00 till 12:30 there is no netting of fix deals positions with opposite spot (TOM) deals positions of the participant

- After 12:30 opposite netting of fix deals (and TOM deals) positions is available

- After FX Fixing rate is calculated and applied to fix deals a part of collateral is unblocked and same margin (6%) as for spot (incl. TOM) transaction position is applied

- Settlements are provided by NCC in day T+1 (value date TOM)